salt tax deduction new york

This number apparently is an estimate of the amount New Yorkers would now be saving if the SALT deduction had been preserved in combination with all. Lets break down how it impacts taxpayers who itemize taxes and live in high-tax states.

What Is The Salt Tax Deduction Forbes Advisor

Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug.

. April 11 2021 700 pm ET. Your Key New York Taxes Guidebook For 2022. Federal income tax purposes for tax years beginning after December 31 2017 and before January 1 2026 imposed as part of the Tax Cuts and Jobs Act of 2017.

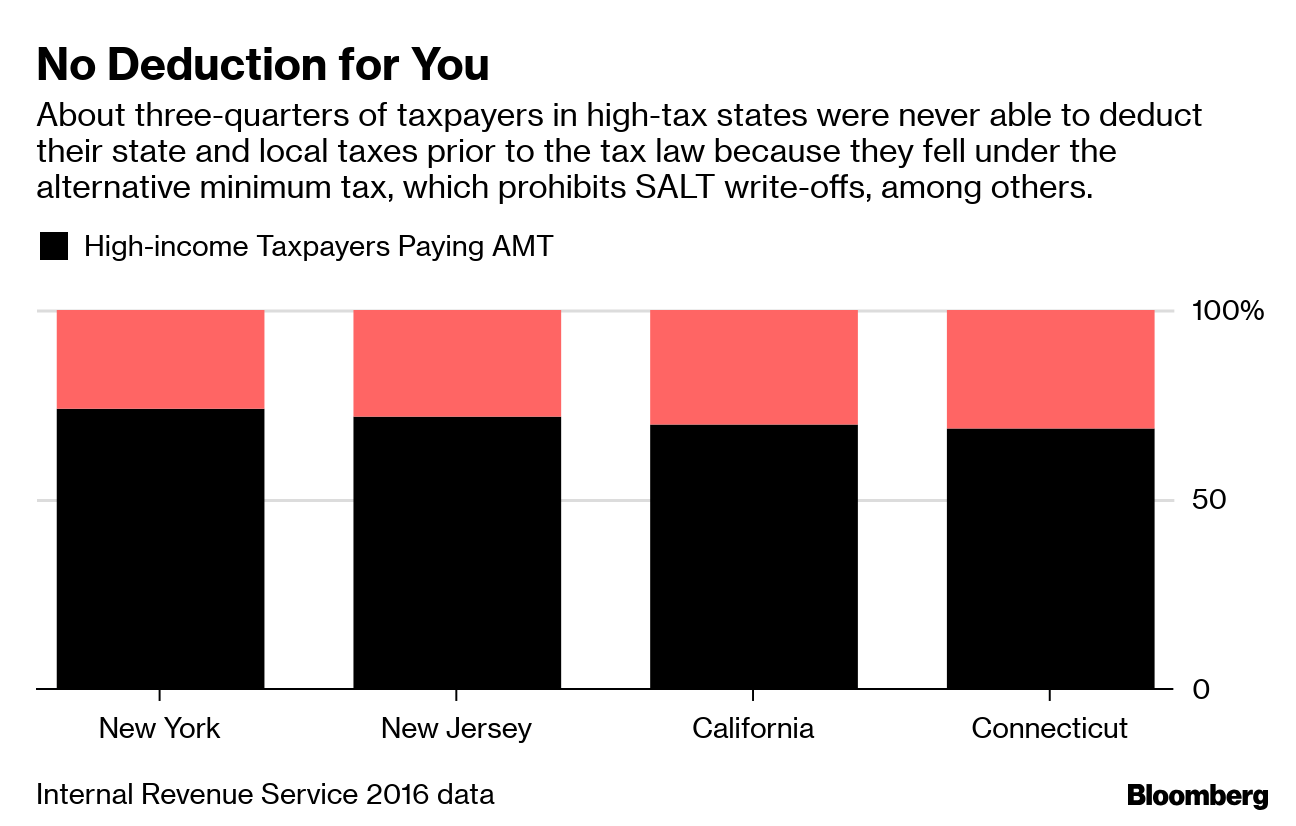

The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to subjected individuals. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is known as. Print eBook Format.

Individual taxpayers who itemize their personal deductions. Print PDF Format. Print PDF Format.

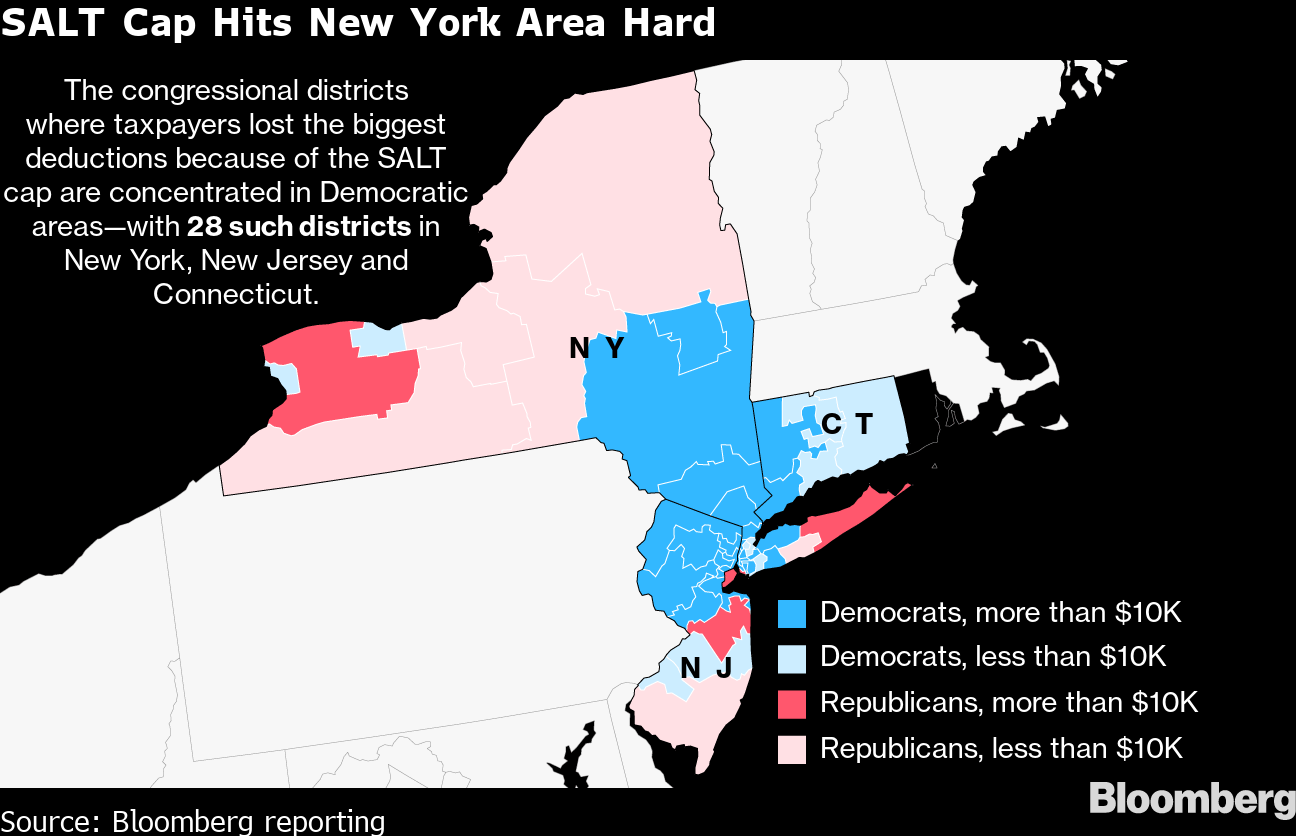

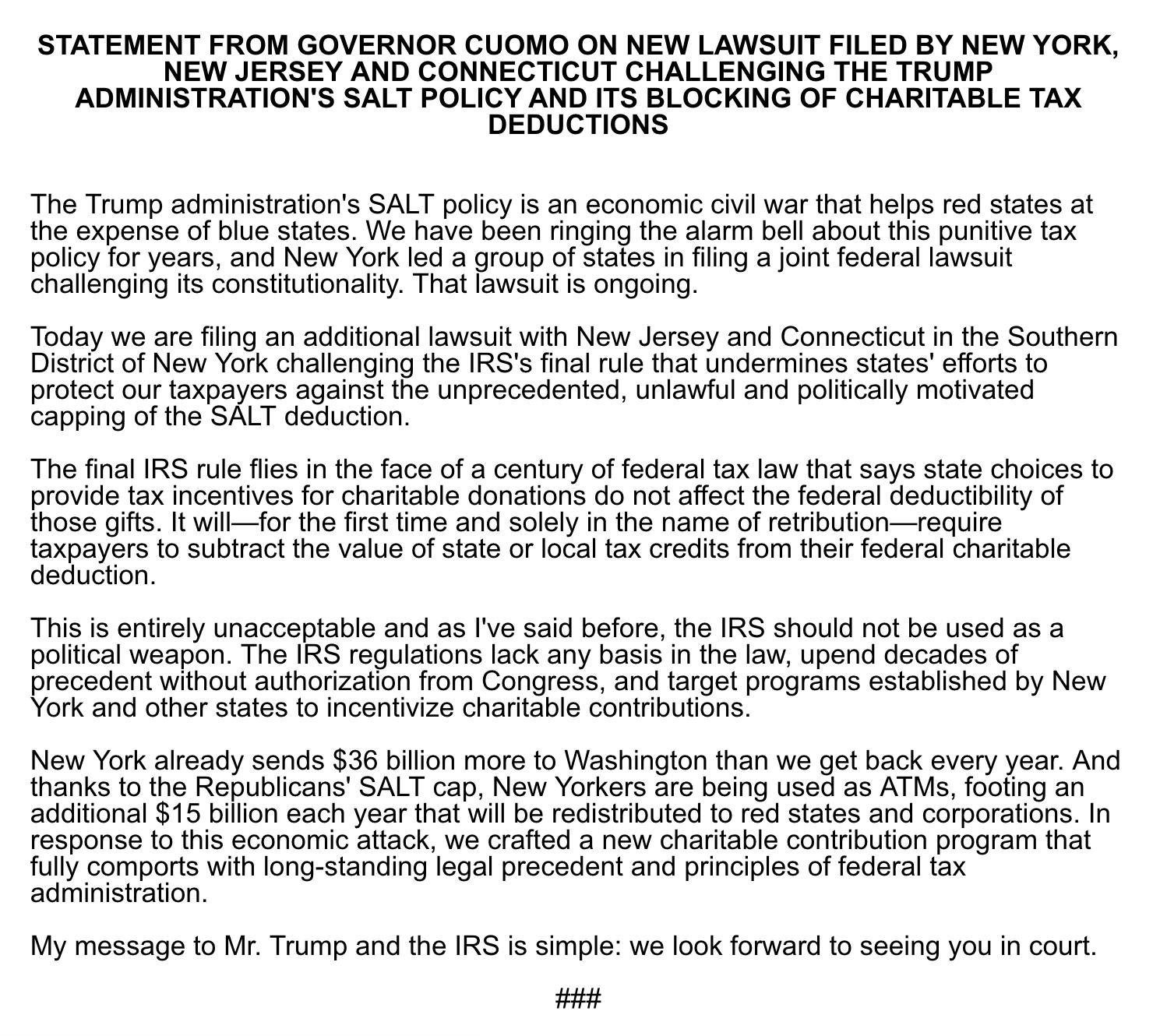

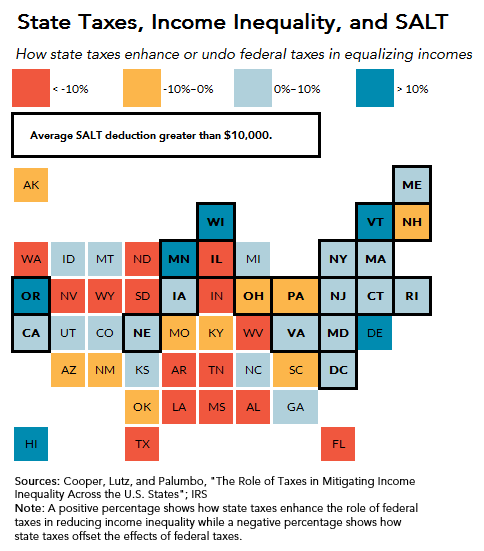

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local. Why should someone in Pennsylvania earning 100000 pay more federal income tax than someone in. The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on.

Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and. In New York the. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either.

The Tax Cuts and Jobs Act TCJA capped it at 10000 per year consisting of property taxes plus state income or sales taxes but. The Debate Over a Tax Deduction. Scott is a New York attorney with extensive experience in tax corporate financial and nonprofit law and public policy.

In tax years 2018 to 2025. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The 10000 cap means the average New York taxpayer loses out on more than 12000 of SALT deductions each year.

Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. Print eBook Format. The federal offset of saving 1.

The SALT cap is the limit on a persons ability to deduct state and local taxes in excess of 10000 for US. As with many other elements of the. For many individuals the state income tax withheld plus the high real estate taxes often paid on the coasts greatly exceeded the maximum deduction of 10000.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to 15 billion a year in higher federal taxes.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their. Will SALT Deductions Be Uncapped. For example a New York taxpayer with 1500000 in taxable income would pay 102750 in.

Ad Leading Resource For Tax Practitioners. For example the average SALT deduction claimed in New York was 23804 in 2017 and 5451 in Alaska in the same year according to Internal Revenue Service data. Ad Leading Resource For Tax Practitioners.

Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle class and the wealthy. Your Key New York Taxes Guidebook For 2022. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025.

The 10000 cap means the. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer.

Menu burger Close thin Facebook Twitter Google plus.

States Help Business Owners Save Big On Federal Taxes With Salt Cap Workarounds Wsj

New York Democrats Push Repeal Of Cap On Local Tax Deductions Wsj

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

Rich Democratic Lawmakers Stand To Benefit From The Salt Tax Cuts

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

Filing Your Ny Tax Returns Tips On What You Need To Know In 2019

Many Rich Fretting About Salt Didn T Get Break Before Trump Law Bloomberg

New York High Tax States Dealt Salt Cap Blow In Court But Fight Likely Not Over Fox Business

Ocasio Cortez Votes Against Repeal Of Salt Deduction Cap

Blue States Ask Supreme Court To Review Salt Tax Deduction Caps

The Price We Pay For Capping The Salt Deduction Tax Policy Center

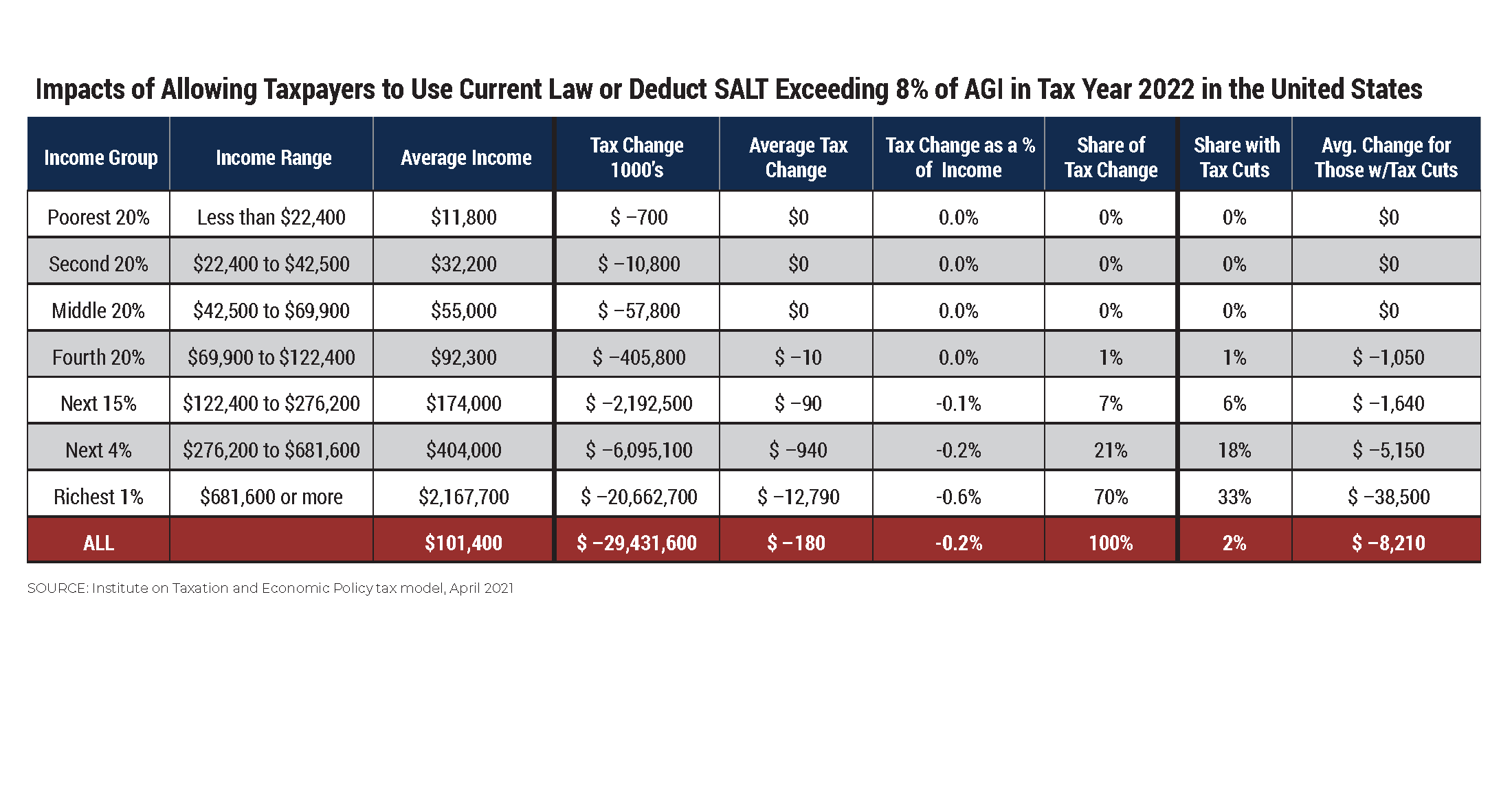

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What Is The Salt Deduction H R Block

Take Claims About State And Local Tax Deductions With A Grain Of Salt The New York Times